Voluntary Benefits: An Essential Guide for Employers and Brokers

Voluntary Benefits: An Essential Guide For Employers and Brokers

How Employees, Employers and Benefits Brokers All Win When It Comes to Voluntary Benefits.

Labor demographics heading into 2019 are ever changing. There are more young people employed, and with unemployment at the lowest it has been in some time, the demand to fill positions within businesses is becoming harder to do. Because of these trending issues, employers are looking into ways on how they can attract, attain, and retain top talent for their organization by revamping their overall benefits offerings for employees. This can often include implementing a comprehensive voluntary benefits package.

Employees, employers and benefits brokers all win when it comes to voluntary benefits.

Why?

- Voluntary benefits give employees more customization options, so they feel they have the full coverage they need

- Most voluntary benefits can be added to an employer’s benefits program for little to no cost to the company

- These programs are huge in an employer’s ability to attain and retain top talent

- Voluntary benefits offer brokers an additional route of revenue that can be fruitful and long-lasting

What Are Voluntary Benefits What are the Different Kinds of Voluntary Benefits What are the Perks of Voluntary Benefits Benefits Brokers and Voluntary Benefits Voluntary Benefits FAQ Voluntary Benefits Administration Software

To put this all into perspective, group employee health insurance is expected to be about $15,000 per employee in 2019. And with employers typically covering about 70 percent of these costs, you can see why it’s more important than ever for benefits brokers to be able to provide quality options to their clientele that will not only improve the well-being of employees, but also not break the bank for businesses either. After all, aside from the pay, an employer’s benefits program is typically evaluated and scrutinized the most by potential employees deciding whether or not they want to accept a job with them. Some employees will even consider taking a lower paying job if the benefits offered make sense for them.

What Are Voluntary Benefits?

Voluntary benefits—or supplemental benefits—are products offered through an employer but are paid for partially or solely by workers through payroll deductions. An attractive perk of these benefits is that they can offer individual employees group rates that they would be unlikely to find on their own.

They are extremely important for employees who want to fill the voids of coverage where their traditional benefits don’t give them the insurance they need based on varying life circumstances, current situations, and down the road for those who plan ahead.

What Are the Different Kinds of Voluntary Benefits?

Voluntary benefits range from life category to life category such as health, dental, wellness/lifestyle, financial security, personal/miscellaneous, and more. There are tons of in-demand voluntary benefit options that employers can add to their packages at very little or no cost to them.

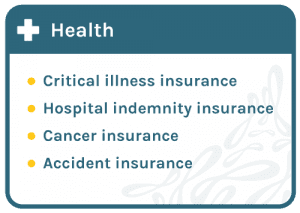

Health

Critical illness insurance—This coverage complements major medical coverage by providing lump-sum benefit for an employee diagnosed with a covered critical illness.

Cancer insurance—This supplemental benefit helps manage the risks associated with the cancer disease and its many mutations. It is used to mitigate the costs of cancer treatment and provide policyholders with a degree of financial support.

Hospital indemnity insurance—This coverage provides a lump-sum benefit to help with the out-of-pocket costs related to a hospital stay.

Accident insurance—This plan helps offset the unexpected medical expenses that result from an accidental injury.

Dental

Dental insurance provides benefits for both routine and expensive procedures that are not covered by most health insurance plans. Coverage typically includes cleaning, fillings, tooth removal, sealants, dentures, and more.

Wellness/Lifestyle

Legal services—This benefit typically gives employees access to qualified attorneys at a reduced cost. It will usually cover legal matters which include families, automobiles, civil lawsuits, real estate, and wills.

Disability insurance—Employees who become disabled as a result of a covered accident or illness will have a percentage of their income covered.

Other wellness benefit ideas that employers can implement with no or little to no cost include access to gym memberships, virtual healthcare access, providing access to a rec area for employees, and more.

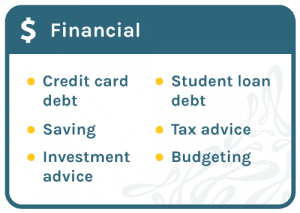

Financial

As 40 percent of Americans can’t cover a $400 emergency expense, it should come as no surprise that financial supplemental benefits are beginning to become more popular. This coverage helps employees manage their finances. The range of topics financial counseling covers includes:

- Credit card debt

- Student loan debt

- Investment advice

- Tax advice

- Saving

- Budgeting

Security

Life insurance—This benefit pays a lump-sum of financial protection to an employee’s family member(s) in the event of their death. Coverage can be updated when life events such as getting married, having a child, and/or buying a home happens.

Identity theft protection—While this benefit doesn’t cover any financial loss due to identity theft, it is used to monitor public records and alert those signed up of any fraudulent use of their personal details. It monitors attempted loan and credit card applications, while also covering the costs for repairing a person’s credit history

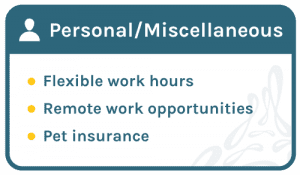

Personal/Miscellaneous

Flexible work hours—This perk allows for employees to pick and choose which time they arrive to work. It completely upends the traditional 9-5 thinking. Employees love this perk because it allows them to take care of their kids in the mornings, lets night owls sleep in, or for those who have an unexpected issue arise. This is a valuable perk if employees are keeping up with their job requirements.

Remote work opportunities—This is a benefit that allows employees to basically pick and choose where they work, whether that is at home or elsewhere. It’s clear that a lot of work objectives today can be done outside of the work campus since most businesses operate using the internet.

Pet Insurance—Our pets are family. This benefit helps to cover the costs of veterinary care if your pet becomes ill or injured. Some programs provide reimbursement programs for wellness procedures such as vaccinations, spaying/neutering, and heartworm testing.

What Are The Perks of Voluntary Benefits?

To Employers

Many voluntary benefits can be added to an employer’s offering at little to no cost to them because a lot of employees today are willing to pay for the coverage themselves through salary-deferred contributions. Employers who offer in-demand supplemental benefits see:

- An increase in workforce productivity

- An increase in the talent pool available to them when they are looking to fill open positions

- A decrease in the amount of employee churn over time

Did you know that 92 percent of U.S. employers believe voluntary benefits and service will be important to their employee value proposition over the next three to five years?

To Employees

Employees view supplemental benefits as important pieces to their overall package. When they feel covered, safe, healthy, and happy they become more productive in their jobs. Another benefit for employees buying voluntary benefits is that it’s cost effective for them to purchase through a group plan provided by the employer. Overall, when employees have access to voluntary benefits, they are more confident in their financial future.

Did you know that 62 percent of employees under 50 wouldn’t consider working for a company that didn’t offer voluntary benefits?

Benefits Brokers and Voluntary Benefits

Brokers offering voluntary benefits to their clients can be just what they need to meet or exceed their sales goals.

The Advantages of Offering Voluntary Benefits

As high-deductible plans are becoming more normal and more expensive, the need for flexibility in plan design makes these benefits a valuable tool for brokers. Brokers who offer voluntary benefits can help their clients by:

- Enhancing their medical coverage by filling in the gaps a traditional healthcare plan won’t cover

- Giving employees the ability to customize their protection

- Offering customized enrollment and communication design

- Giving added protection at no cost to employers

Did you know that a typical Critical Illness policy carries a $2,000 premium, with a 70 percent first-year commission, and 4 percent renewal commissions each-year-following is paid to the writing agent?

Evaluating Your Clients’ Need for Voluntary Benefits Packages

A survey revealed that 70 percent of employers believe their current benefits offering meets their employees’ needs—but only half of employees actually believe that notion. There is clearly a disconnect between the working and managing populations. This is where the broker can come in and help figure out where the disconnect lies by identifying the voluntary benefits the employee population really needs.

Brokers can do the following to help create harmony for their clients and the employees they oversee.

Identify the benefits objectives their clients are looking for:

- Consider business and HR objectives

- Employer size, location, industry, and collective bargaining agreements

- Budget

- Any other future objectives

Identify the needs of the employees:

- Consider employee interviews, questionnaires and surveys

- Review current benefits plan and compare it to the client’s competitor’s plan

- Analyze employee demographics

- Work to fill the needs of the younger vs older workers

Make sure you are up-to-date on current legislation:

- Consider all legal obligations the client may have

Create the benefits offering:

- Evaluate the costs of every offering to stay within budget

- Help clients determine where costs can be reduced

- Which benefits are most valuable

- Employee contributions amounts if needed

Communicate with your client:

- Go beyond the legal compliance and disclosure of plan summary communications

- Set time aside to educate employees about what they are getting into

- Create buy-in with transparency

Evaluate the plan periodically:

- Review your clients’ plans on a regular basis to determine if it continues to meet their needs

- Work with clients to develop goals

- Keep communication open

- Stay on top of ever evolving legislative agendas

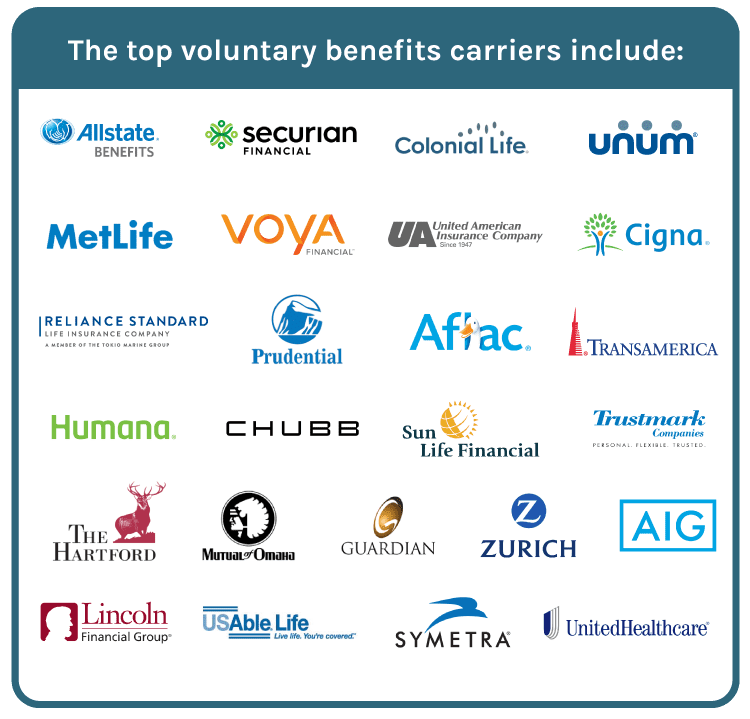

Who are the Top Voluntary Benefits Carriers?

The top voluntary benefits carriers include:

- Allstate Benefits

- Aflac

- Colonial Life

- Unum

- Lincoln Financial Group

- MetLife

- Voya Financial

- United American Insurance Company

- Cigna

- Mutual of Omaha

- Reliance Standard

- Prudential

- Securian

- Transamerica

- Humana

- Chubb

- Sun Life Financial

- Symetra

- Guardian

- The Hartford

- USAble Life

- UnitedHealthcare

- Zurich American Insurance Company

- AIG

- Trustmark Insurance company

Voluntary Benefits FAQ

How are voluntary benefits cost effective?

For employers, a common misconception is that by offering voluntary benefits to their employees it will cost them big. However, the reality is that employers can offer these supplemental benefits at no direct cost to themselves.

For employees, it’s cost effective for them to buy these plans at group rates, directly through their employer, compared to taking the time themselves to find a plan that won’t offer an equivalent discounted rate if they go through a 3rd party carrier directly.

What sized companies benefit from voluntary benefits?

Believe it or not, businesses do not have to be a giant corporation to offer voluntary benefits to their employees either. Some plans require an employer to hold a minimum of two to five employees on staff, while some others have policies that have no minimum requirements whatsoever.

Which voluntary benefits are the most popular?

The following voluntary benefits are currently the most popular options being offered by brokers today:

- Accident insurance

- Critical Illness insurance

- Short-Term Disability insurance

- Term Life

Are voluntary benefits offerings profitable for benefits brokers?

In short, yes. Use these stats to help put into perspective the opportunities brokers have when selling voluntary benefits:

- A typical Critical Illness policy carries a $2,000 premium, with a 70 percent first-year commission, and 4 percent renewal commissions each-year-following is paid to the writing agent.

- 28 percent of brokers say that voluntary sales account for 11-25 percent of their total revenue

- 40 percent write more than 10 voluntary cases a year, which is a 10 percent increase from 2017

- 57 percent sell or cross-sell voluntary benefits to accounts compared to 48 percent in 2015

Who is eligible to receive voluntary benefits?

Most employees are eligible to sign up for voluntary benefits through their employer. However, like how benefit offerings work for most companies, they are only able to offer them based on federal, state, and/or local laws—as well as the requirements determined by employers themselves on who qualifies for what benefits.

Voluntary Benefits Administration Software

Increasing employee engagement and communication, navigating the challenges of ACA compliance, and seamlessly handling the transfer of employee voluntary selections to appropriate carriers during Open Enrollment are all elements of benefits administration technology that employers today are looking to add most.

Benefits brokers win big when they partner their offerings with a cloud-based human capital management (HCM) platform—and its automated HR/payroll modules—that they can offer to their clients. The technology available helps employers automate crucial workflows in the benefits management arena to simplify the process for both administrators managing the platform and the employees utilizing it.

The beauty of an automated HCM platform is that data is corralled in a single-source database which allows for the free flow of information to transfer internally and/or externally to third-party vendors via integrations. Cloud-based, HCM technology promotes efficiencies to both end users and administrators by automating manual tasks and workflows, reducing the need for paper, customizing impactful reports, therefore saving hours of time, money, and more.

Benefits Brokers also win by improving their overall sales and by providing their clients with new technology that can scale to meet the needs of a companies’ ever-changing requirements over the long-term. By providing your clients with HCM technology that works, over time, they will continue to want to use it, as well as potentially add more modules to improve other areas of their HR operations.

Find out more about how the Unum Voluntary Benefits Widget increased sales for Arcoro’s partner, Alexander & Company, by clicking here!

Arcoro’s cloud-based, automated full HCM platform is the perfect option for benefits brokers who need a strong HCM, benefits management and ACA compliance partner to combine within their current benefits offerings. With seamless integrations to top carriers such as Unum, Aflac, BlueCross BlueShield and more, consultants partnering with Arcoro have seen their opportunity-share rise in the market they are chasing.

The full HCM platform also offers modules in the following areas:

- Benefits Management

- ACA Compliance

- Employee self-service (Employee Portal)

- Payroll Processing

- Recruiting Applicant Tracking

- Time and Attendance

- Reporting

- Performance Management and Feedback Delivery

- Online Learning Management

- Succession Planning

- Employee Onboarding

- Surveys

- Job Posting and more