As the nation’s healthcare costs continue to climb with no end in sight due to partisan politics, chronic illnesses and rising drug costs, more businesses today are offering high deductible healthcare plans (HDHPs) to help offset those costs. With Open Enrollment currently ramping up, businesses are finding it extremely hard to explain to their employee base what exactly an HDHP offering is and if it is the right fit for them and/or their families.

According to SHRM:

HDHPs are considered consumer-driven plans when linked to health savings accounts (HSAs) or health reimbursement arrangements (HRAs), which give participants a financial incentive to spend health care dollars prudently.

To add to that, according to Jeff Benz, President of Benz Communications, “As more employers offer high deductible plans, they need to make efforts to ensure employees and their families are properly educated about the plans and the financial opportunities and risks,” he said. “While many employees can save money with a high-deductible health plan, they aren’t for everyone. Where employers offer a choice of plans, they can help employees make the right decisions by explaining the possible risks, helping them understand their financial responsibilities and showing them how to compare health plans.”

Let’s talk about a few creative ways you can better engage your employees on what exactly a HDHP is and how it will affect them and their families overall.

Strategies to explain high deductible healthcare plans to employees and their families

These communication tactics should help businesses be able to better relay HDHP messaging to their employee base.

Pretend you’re the marketing department

There is no such thing as a one-size-fits-all communication method, especially when it comes to explaining the nuances of healthcare and the plans that are available. Businesses should not be afraid to use a variety of different messaging tactics to explain the difference in HDHPs.

During this time of the year, HR, leadership, or whoever is tasked with Open Enrollment management for the company needs to put themselves in their marketing counterpart’s shoes and figure out what types of messaging will hit closest to home with their employee base. Messaging can take the form of emails, infographics, brochures, PowerPoint, group meetings, webcasts and more.

These examples give an array of consumption options for an employee base who digests their information differently.

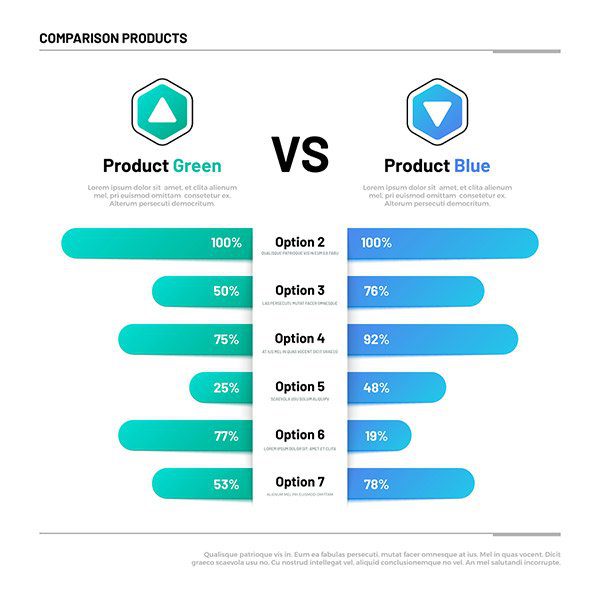

Use side-by-side comparisons

A simple way to explain the difference between HDHPs and other employer-provided plans is by creating side-by-side comparisons of the different options available to them.

The biggest takeaway from this strategy is cost comparison in plans.

Businesses should keep it simple and easy to consume. Information should include an explanation of the different cost definitions such as:

- Premiums

- Out-of-pocket maximums

- Deductibles

Companies should be clearly comparing HDHPs with the other options it offers, explaining the benefits pros and cons of both for a diverse demographic.

Using a visual comparison chart can be helpful in explaining the differences between plans.

Use real-life examples or create fictional possibilities based on real-life scenarios

People understand and absorb information better when they can see clearly how they and/or their family will be affected by hypothetical outcomes. The goal for businesses should be to strategize over ways they can get their employees to visualize themselves in various scenarios.

They can create scenarios based on age, family member coverage, type of care as well as the potential use frequency. It’s up to these businesses, however, to really know the demographics of their employee base to create these real-life examples. Businesses can learn more about their workforce demographics through the data they’ve compiled on them over time, or a simple survey should be used to get this information.

Provide resources to determine cost-of-care scenarios

An addition to the real-life scenarios, companies should be outlining contrasting provider care situations in which they show their employees how the cost of care can fluctuate between providers.

To assist in the knowledge transfer, businesses can lead their employee base to price-estimator tools. These tools can generally be found on most health insurance websites. With access to these tools, employees can visually learn that an X-ray may cost $200 with one provider, while it may be $2,000 at another.

These types of tools will help paint a clearer picture for an employee base who can find healthcare and their benefits confusing.

Related Reading:

The Brokers’ Guide to HR Automation Sales

How to Improve Employee Engagement During Open Enrollment

5 Rising Voluntary Benefits Employers Should Offer to Their Employers

The Critical Illness Insurance Market Continues to Trend Upward in the US

The Arcoro platform offers benefits brokers, administrators and end users the scalable solutions they are looking for most. The HCM platform includes the following modules:

- Benefits Management

- Applicant Tracking

- Payroll

- Employee Self-Service

- Performance Management

- Reporting

- Surveys

- Time and Attendance

- Time-Off Tracking

- Workflow Management

- EZSign (electronic signature)